Crypto markets holding on to weekend gains; Bitcoin still dominating, XRP moving up, ETH retreating slowly.

Market Wrap

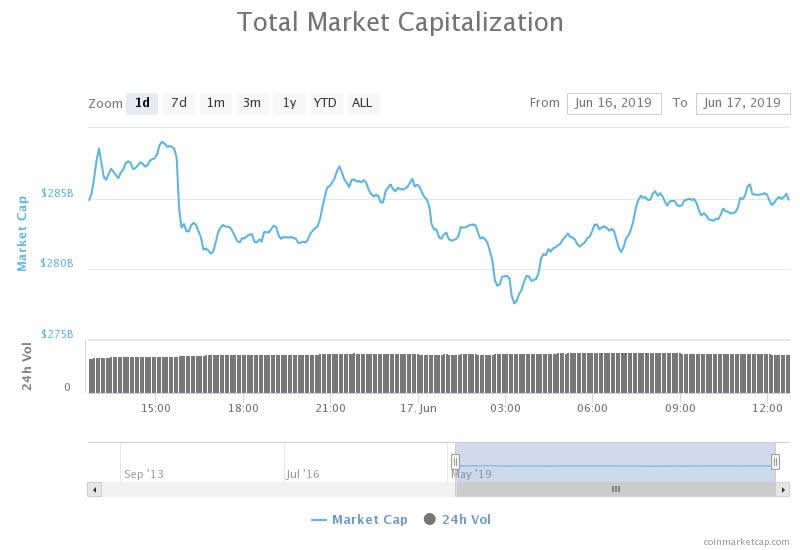

Crypto markets have held on to weekend gains and there has been no typical ‘Red Monday’ reaction so far. Bitcoin’s surge to new 2019 highs has buoyed up markets and several altcoins have also gained. A number have fallen however, but in general total market capitalization is high and holding above $280 billion.

Bitcoin traded above $9,300 twice yesterday marking a new high for thirteen months. A pullback dropped BTC price back to high $8,000s but it quickly recovered during Asian trading today to reach $9,200 again at the time of writing. Technical indicators and historical highs show a lot of resistance at $9,600 which will need to be broken for BTC to hit five figures.

Ethereum got a weekend boost reaching $278 but it has not been able to follow Bitcoin and hold those gains. ETH is down 2 percent since yesterday dropping prices back below $270. The longer term trend for ETH is still up though so more momentum could take it to $280 this week.

Top twenty movements are also mixed with Cosmos and Tezos getting the best performance adding over 4 percent each to reach $6.54 and $1.33 respectively. NEO has added almost 3 percent and NEM is back in the big twenty with a 5 percent gain. As above, the rest are pretty flat this morning.

FOMO: A Smiles For Grin

Entering the crypto top one hundred with a 12 percent push is Grin, a private lightweight blockchain based on mimblewimble. The only thing that could be driving momentum is an approaching hard forknext month. Bytom is the only other double digit altcoin today with 11 percent added, BitTorrent token is third gaining over 8 percent.

There are no big dumps going on as markets remain flat on the day. At the bottom of the pile right now is Dent, MaidSafeCoin, and KuCoin Shares dropping 5-6 percent.

Market Wrap is a section that takes a daily look at the top cryptocurrencies during the current trading session and analyses the best-performing ones, looking for trends and possible fundamentals.

0 Comments